Vol. 39 (Nº 01) Year 2018. Page 24

Vol. 39 (Nº 01) Year 2018. Page 24

L.A. MAZHAROVA; M.S. AGAFONOVA; Y.S. STROGANOVA; L.V. SHEVCHENKO 1

Received: 28/08/2017 • Approved: 03/10/2017

2.Conceptual foundations of establishment of PPP

3. Development of the methodology of PPP effectiveness

4. Conclusions and recommendations

ABSTRACT: The article analyzes the modern stage of development of public-private partnership (PPP) in Russia and determines the main problems and their reasons. The general scheme of the proprietary methodology of evaluation of the PPP projects’ effectiveness is offered, based on consideration of economic and social effects. |

RESUMEN: El artículo analiza la etapa moderna de desarrollo de la asociación público-privada (PPP) en Rusia y determina los principales problemas y sus razones. Se ofrece el esquema general de la metodología patentada de evaluación de la efectividad de los proyectos de APP, basado en la consideración de los efectos económicos y sociales. |

For several decades, public-private partnership (PPP) has been a popular tools of development of the national socio-economic system of any democratic state. The purpose of this research is to develop a general scheme of evaluation of PPP projects’ effectiveness which takes into account the existing situation and perspectives of its development.

The tasks within the set goal are the following:

- analysis of the existing situation in the sphere of PPP;

- study of problems that reduce effectiveness of PPP and of their reasons;

- formulation of the theoretical basis of evaluation of effectiveness of PPP projects;

- selection and substantiation of effectiveness criteria.

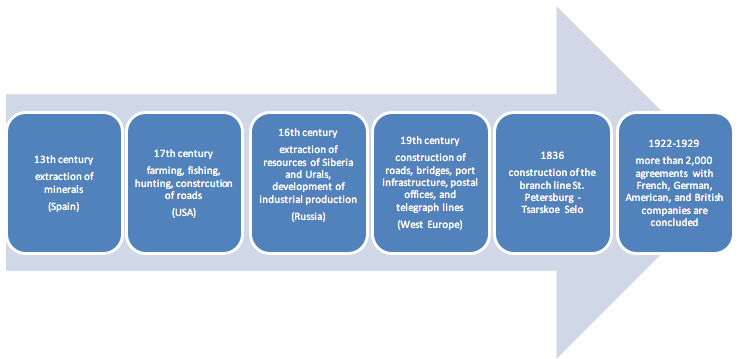

At present, it is possible to state active development of various forms of PPP. This is confirmed by foreign and Russian experience. Thus, the first concession – the agreement of joint financing and the following division of income from the project – was provided by the king of Spain to a private person in 1256. Its object was extraction of natural resources on the lands that belonged to the state [1].

Participation of individuals in development of natural resources and creation of infrastructure used to be a popular practice in the history of the USA. Thus, in the 17th century, governors of the states issued concessions for land tilling, fishing, hunting, and road construction.

In a sense that is similar to modern understanding, public-private partnership began to actively develop in the 19th century, when the objects of agreements between “public authorities and business” included construction of roads, bridges, port infrastructure, postal stations, and telegraph lines. During that period, the very treatment of public-private partnership was expanded, as the private companies participating in such projects started providing not only the financial assets but their employees as they were the necessary specialists of, for example, engineering and technical profile.

In Russia, public-private partnership developed in the course of the global tendencies in the 17th – 19th centuries: e.g., the first Russian concession was provided to a British company in 1555. After that, the concession agreements were actively used during development of the resources of Siberia and Ural, as well as during development of industrial production, including production for army and navy. Thus, during the ruling of Peter the Great, there was a popular form of cooperation during which the state provided private plants with fuel and workforce, receiving the preferential right to purchase the products for the fixed price.

In the 19th – early 20th centuries, public-private partnership played an important role in development of railroad connection. In 1836, Nickolas I provided a concession for construction of a branch railway line “St. Petersburg – Tsarskoe Selo” to a businessman F. von Gersten, who was given a free land plot and the necessary guarantees.

The next period of “flourish” of public-private partnership was the period of the New Economic Policy, when the law allowed involvement of foreign companies into a wide specter of activities. Thus, in 1922 a “typical concession agreement” was issued, based on which 1922-1929 saw the conclusion of more than 2,000 contracts with French, German, American, and British companies. With the end of the period of the New Economic Policy, the concession mechanism ceased to be used and was canceled by law in 1937.

Development of the first concessions (agreements of joint financing and further division of income from the project) is shown in Figure 1.

Figure 1

Development of various forms of PPP, by concessions

In modern Russia, public-private partnership became legally possible only in 1990, but realization of important projects was started only in 2000’s. Unlike the given historical examples, the “commercial partners” of the state were not foreign but domestic companies [1].

Despite the long history of development of PPP, the topics related to public-private partnership are especially topical in Russia. This is explained by complex geo-political conditions in which our country finds itself. Thus, in the conditions of economic sanctions and high load on the budget system, the state is interested in the search for partners and attraction of additional financial, material, HR, and other resources for realization of socially important projects. On the other hand, a lot of large companies are interested in realization of large-scale and long-term projects in the RF, but still prefer the ones with low risks. These conditions could be ensured by the administrative resource of the state. At the same time, successful realization of the public-private partnership projects is possible only in case of coincidence of partners’ expectations, and the correspondence of expectations and results. Thus, the issue of specifics of evaluation of PPP projects effectiveness is very topical.

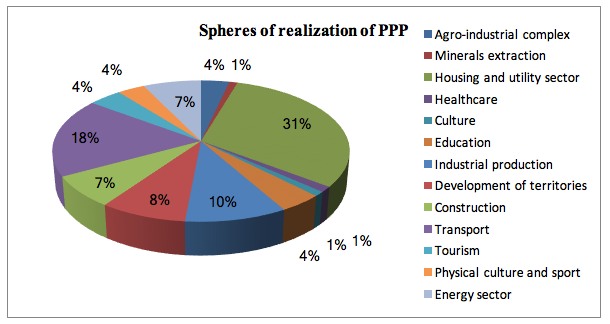

Thus, over the recent 20 years, the PPP projects in the sphere of infrastructure accounted for EUR 200 billion in the countries of Europe [4]. In Russia, this form of interaction of public authorities and business is also rather widespread: at present, at the federal, regional, and local levels, over 1,300 projects that suppose PPP with the total volume of investments of RUB 2.33 are being realized [7]. These projects cover a rather wide specter of the spheres that are related to the functions of the state (Fig. 2)

Figure 2

The sectorial structure of PPP projects.

Source: [7]

These facts allow for the conclusion that PPP, as a socio-economic institute, has passed the stage of establishment in Russia, during which two serious tasks were solved:

Table 1

Normative and legal basis of PPP

|

Type of PPP |

Normative and legal basis |

1. |

Agreement on PPP (agreement, according to which the private partners will create – fully or partially by his own or borrowed assets – immovable assets or immovable assets and movable assets technologically connected to each other, and the public partner (state) will provide the private partners the ownership and usage rights for conducting the activities specified in the agreement and ensure the emergence the private partner’s ownership right for the object of the agreement under the condition of observation of the requirements envisaged by the effective law and the agreement).

|

Federal law “On public-private partnership and municipal-private partnership in the Russian Federation and amendments into certain legal acts of the Russian Federation” dated July 13, 2015, No. 224-FZ, regional law |

2. |

Life cycle contract/long-term contract (contract that supposes purchase of product or service (including with necessity for design of the object that has to be created as a result of execution of the work), further service, maintenance, and exploitation and (or) utilization of the shipped product or the object created as a result of completion of the work)

|

Federal law “On the contractual system in the sphere of purchase of goods, works, and services for provision for state and municipal needs” dated April 5, 2013, No. 44-FZ |

|

Concession agreement (concession) (agreement, according to which the concessioner will create and (or) reconstruct a certain immovable asset, the ownership right for which belongs or will belong to the RF, conduct activity with the use (exploitation) of the object of the concession agreement, and the RF will provide the concessioner for the term envisaged by the agreement the ownership and usage rights for using the object of the concession agreement for conducting the specified activity. At that, the concessioner bears a risk of random destruction or damage of the concession agreement object. Concession agreements are concluded on a competitive basis). |

Federal law “On concession agreements” dated July 21, 2005, No. 115-FZ

|

3. |

Agreement within the system of state purchases (agreement concluded on behalf of the RF, subject of the RF (state contract), municipal entity (municipal contract) by state or municipal customer with a supplier of goods, works, and services for provision of state and municipal needs, accordingly). |

|

4. |

Investment agreement (agreement between investor and state regarding the order, volume, terms, and forms of realization of the investment project, in which investor will invest assets and will realize the agreed investment projects, and the state, in its turn, provides him with a possibility of realization: gives land, other objects of immovable property, provides licenses, sets subsidies, and provides guarantees) |

Civil Code of the RF, Budget Code of the RF, Land Code of the RF |

2. A positive attitude towards participation in public-private partnership with the commercial companies has been formed: ca. 70% of Russian companies’ managers view the participation in PPP projects (real or hypothetical) as a positive experience for their business [4].

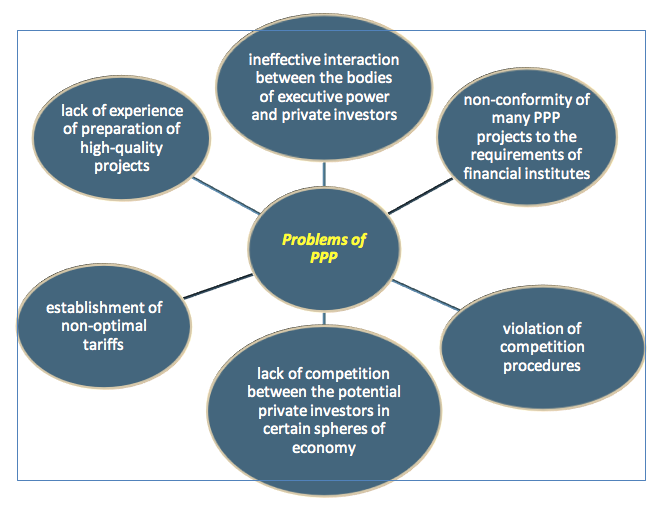

At the same time, despite active development of the PPP practice, there’s a large problem of a number of “failed projects”, realization of which was not finished or which were realized with substantial increase of terms or initial conditions – in certain spheres their number reaches 30% [4].

The most popular problems which lead to such situation include the following (Figure 3):

Figure 3

Problems of development of PPP

Thus, in our opinion, the issue of improvement of the system of evaluation of PPP projects evaluation, conducted by the state bodies at the stage of selection and preparation of projects, is very topical.

The generally accepted practice is assessment of PPP project effectiveness that includes three directions:

– comparison of profitability of realization of the project with attraction of private partner and without it;

– determination of types of risks for the realization of PPP projects, their assessment and determination of the form of risk management;

–detailed economic substantiation of PPP [2].

That is, here we speak of assessment of economic effectiveness.

In our opinion, it is expedient to expand the criteria of effectiveness by means of fuller consideration of material and non-material profits of not only the public partner (state) but private partner (commercial company), the profits of which are often considered “by default”. Such approach will allow for assessment of the private partner’s interest not only in conclusion of the agreement but in successful realization and finish of the project.

Let us view the specifics of each partner.

State is a specific participant of economic relations. On the one hand, the activity is based on the notion “general benefit”, which is expressed in such goals as achievement of economic growth, provision of socially unprotected groups, quality assurance, etc.

On the other hand, direct representatives of state have their own interests close to the private sector – receipt of profits that exceed the expenses, presented in the theory of public choice (Table 2).

Table 2

Classification of groups of subjects that present the state

Group of participants |

Targeted settings |

1. Politicians |

Re-election that ensures high social status and access to the process of benefits’ distribution |

4. State officials (bureaucrats) |

Preservation of the office or increase of the status that provides access to independent use of various resources |

These targeted settings allow us to speak about the lack of insurmountable differences between the persons acting “on behalf” of the state and “on behalf” of private business – i.e., about the unity of motives and their economic nature.

The above settings, if applied to the PPP projects, can become – depending on the conditions – a reasons of corruption and a motive for development of competitive relations between the state structures, increase of effectiveness of their work, etc., which makes the issue of motivation of state officials who represent the state in such projects very important.

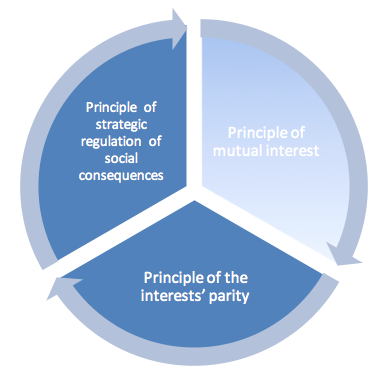

As the methodology, the following principles could be used (Fig. 4):

Figure 4

Methodological principles of PPP

This principle supposes a detailed description (as the initial stage of preparation of a PPP project) of the problem that is to be solved as a result of project realization and of the possible circle of participants (possible private partners, interests bodies of public authorities of various levels), and the object of partnership and possible forms of its implementation.

At that, the specific results which are to be achieved during the project realization should be known and coordinated with interested parties; they also should be determined and fit for measuring and monitoring.

Formalization of the assessment of effectiveness within this principle is possible by means of development of the “models” of PPP in various spheres by the ministries and departments – these models could be adapted for various spheres.

This principle means that all parties to the agreement should determine the positive effects which are different for different parties and are brought down not to one (e.g., profit) but to several indicators.

Thus, for a private company, a positive effect is not only profit, access to new technologies, and image of “reliable company”, and for the state- not only saving budget assets but also the long-term employment of the region’s population, etc.

Besides, certain effects can be manifested at the start of the project realization, and others – only after its successful ending (or at the last stages of realization).

That’s why we deem it expedient to divide effectiveness into “effectiveness of participation in the project” and “effectiveness of successful ending of the project”.

These two types of effectiveness could be evaluated by means of the detailed assessment of separate effects, examples of which are given below (Table 3).

In view of a large number of possible effects, it is impossible to provide general recommendations for increase of effectiveness within this principle.

Obviously, successful realization is possible only under the condition of possible effects with both partners at the stage of realization and after the project.

This will be a guarantee that both partners are interested not only in the conclusion of the agreement but in observation of the terms of its realization.

Table 3

Criteria of effectiveness of PPP

Effectiveness of a PPP project |

|||

Effectiveness of participation in the project |

Effectiveness of successful ending of the project |

||

State (public partner) |

Business (private partner) |

State (public partner) |

Business (private partner) |

- saving budget assets; - provision of population’s employment, etc. |

- growth of incomes; - receipt of tax subsidies; - access to technologies, etc. |

- growth of GDP (GRP); - growth of population’s living standards; - growth of tax revenues of the budget. |

- profit; - growth of capital assets; - growth of competitiveness. |

In practice, realization of this principle is related to evaluation of the profits and risks of each partner.

Thus, entering the partnership, each party expects to receive certain benefits [1] (Table 4).

Table 4

Benefits of public-private partnership

State (public partner) |

Business (private partner) |

- attraction of additional investments into the spheres that are traditionally included into the sphere of budget financing (transport, healthcare, education, etc.);

- attraction of managers, technologies, and techniques from the private sector;

- dividing the expenditures and risks with a private partner. |

- a possibility to enter the sector of public services, which has a stable demand and which is a traditional monopoly of the state;

- realization of the projects that wouldn’t be attractive for investing without participation of the state;

- dividing the expenditures and risks with the state. |

At the same time, public-private partnership is related to certain risks (Table 5).

Table 5

Risk and public-private partnership

State (public partner) |

Business (private partner) |

- risk of insufficient qualification of managers/performers of the project from the private partner; - risk dishonesty of a private partner; - risk of the low quality of services, provided by a private partner.

|

- risk of lack of a public partner’s responsibility for realization of the project; - risk of “delay” of the process of coordination of the project’s various details; - risk of reduction or termination of financing of the project in case of change of priorities of budget expenditures; - complexity of solving the arguments with a public partner. |

High values of these risks may lead to inexpedience of observation of the project’s terms for one or both partners.

In view of the fact that PPP projects are usually socially significant, monitoring of these risks should be performed by both parties during the course of realization of the project.

In general, reduction of risk might be achieved by means of:

– improvement of the laws, including the laws on the issues of settlements of disputes;

– development of efficient guarantees of responsibility (including the managers’ personal responsibility) for both partners;

- redistribution of risks.

For example, a private partner can be granted the additional authorities for current decision making (reduction of risk of “agreements delay”), and the state can be granted the authorities for evaluating the qualification of personnel of a private organization that participates in the project realization (reduction of risk of insufficient qualification);

- attention to the guarantees of stability of technical, economic, and other aspects of the project.

As of early 2017, the Russian Federation has passed the stage of the decision on realization of 2,446 infrastructural projects which suppose attraction of private investments by the principles of PPP. At that, more than 480 projects are developed by public authorities, and 1,000 are structured by a private partner to be started with the mechanism of “private initiative”.

The PPP projects for which there’s a decision on implementation include 17 projects of the federal level, 238 projects of the regional level, and 2,191 projects of the municipal level. In its turn, there are 2,183 PPP projects that passed the stage of commercial closure (conclusion of agreements/contracts, within which the total investment liabilities (liabilities for financing of creation/construction/reconstruction) of public and private side constitute RUB 2.040 trillion, of which the liabilities of private partners constitute RUB 1.336 trillion (65.4%) [4].

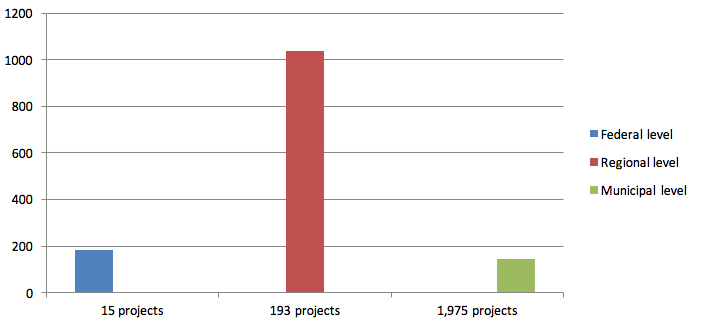

Distribution of the number of projects and “contracted” liabilities of private partners for administrative levels is presented in Figure 5.

Figure 5

Ratio of the number of realized PPP projects and the volume of financial

liabilities of private investors (private investments, RUB billion)

Source: data of the Center of PPP development.

Concession is still the main form of PPP projects’ realization in Russia. 2,200 infrastructural projects are being realized and will be realized in the form of concession agreement. Agreements on PPP are used for structuring the projects in the social sphere (healthcare, education) and include 70 projects concluded according to the regional laws.

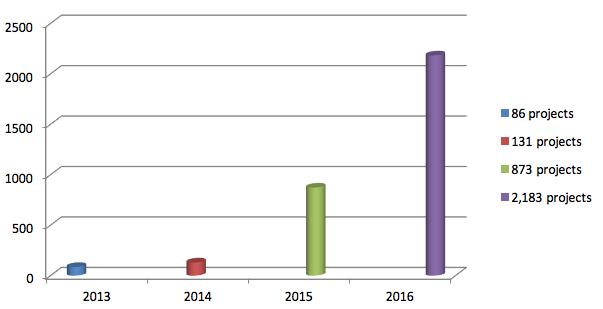

Dynamics of development of PPP projects’ market in Russia: 2013-2016 The rates of PPP projects’ market development in 2016 meet the expectations and forecasts of the experts of the Center of PPP Development (factual CAGR = 124.5% against the forecasted – 130%) (projects that passed the stage of commercial closure were taken into account) (Figure 6).

Figure 6

Dynamics of growth of the number of PPP projects for 2013 - 2016

Source: data of the Center of PPP Development.

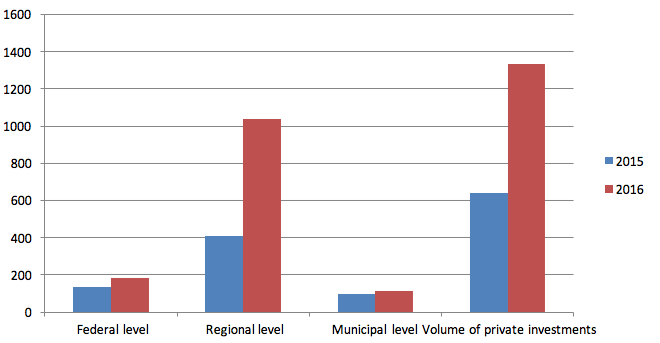

Year 2016 also featured positive dynamics of the growth of PPP projects’ market in monetary terms. The negative trend of 2015 was overcome – negative dynamics of attraction of private investments into infrastructural projects. It is possible to state overcoming of negative factors of the post-crisis period that influenced the PPP projects’ market in 2015. In 2016, within PPP projects, the sum of “contracted” investment liabilities of private partners exceeded the 2015 indicator by 1.5 times and the 2015 indicator – by 2 times (Fig. 7).

Figure 7

Volume of private investments in the PPP projects for 2015-2016 in view of the levels of public authority

Source: data of the Center of PPP Development.

The payment mechanisms and other parameters of PPP projects. The applied mechanisms of private investments return in PPP projects and quasi PPP in the RF could be divided into four groups:

It should be noted that in the modern conditions of a complex geopolitical situation, public-private partnership acquires a special role both as a tool of attracting additional non-budget means and as a tool of creation of a strong and self-sufficient economy.

In order to ensure the growth rate of Russian economy at the level that is now lower than average for the world, it is necessary to ensure growth of investments into transport, energy, social, and communal infrastructure by 6-10% per year in next 5-7 years. However, over the recent five years, real expenditures of the budget for infrastructural spheres were reducing by 10% annually, and this tendency might preserve in the close future. At that, the share of attracted private investments didn’t reach 3% of the total volume of invested assets into infrastructure development. The potential of private sector in development of Russia’s public infrastructure is not used fully, which is caused by historical factors and by the current situation. However, over the recent 5-6 years, due to efforts of public authorities, financing organizations, and business society, the situation began to change – mainly due to active development and application of PPP mechanisms. The potential of using the PPP mechanisms in Russia is related – apart from modernization and development of infrastructure – to increase of effectiveness of managing the state property and growth of financial return from state economic assets; unlike the privatization policy, the state does not lose the property right for such objects. PPP can and should become a key to reforming the system of state management, a new concept of relations of state and business, which can become a locomotive of transformations in the system of state management and in the commercial sector [6].

However, the achievement of these goals requires not only quantitative but also qualitative development of the spheres of PPP: reduction of precedents of violation of terms and court proceedings that are not finished until the end of the projects. One of the aspects of such work might be the methodology of evaluation of effectiveness, the general scheme is presented in this paper.

Agafonova М.S., Gushchina S.V. Methodology of formation and strategy of development of the system of state financial management in Russia // Modern science-based technologies. - 2013. - No. 10-1. - P. 133-134.

Barkalov S.А., Bekirova О.N., Mazharova L.А. Regarding the issue of the role and perspectives of public-private partnership in the modern economic system / S.А. Barkalov, О.N. Bekirova, L.А. Mazharova // “Economics and management”. - Issue 4.1(18). –Voronezh: Nauchnaya Kniga Publ., 2015. – P. 113-119

Gabdullina E.I. Evaluation of effectiveness of PPP projects as a mechanism of interaction between public authorities and business / E.I. Gabdullina // Modern problems of science and education [E-source]. - Issue 2(12). – P. 11-18

Gorchakova, Е.V. Peculiarities of the theory of public-private partnership //Russian entrepreneurship, 2014 –No. 3(249). - P. 25-33

Polyakova I. Effectiveness of PPP in the transport infrastructure / I. Polyakova // Transport of Russia: weekly information and analytical newspaper [E-source]. – URL: http://transportrussia.ru/item/2362-effektivnost-gchp.html (Accessed: 1.10.2016)

Dukhanina А., Agafonova М.S. Income and expenditures of the state budget and their role in economic growth of production // International student scientific bulletin. - 2014. – No. 1. - P. 11.

Public-private partnership in Russia in 2016–2017: current state and trends, ranking of regions / Association “Center of PPP Development”. – М.: Association “Center of PPP Development”, 2016. – 32 p.

Polyakova I. Effectiveness of PPP in the transport infrastructure / I. Polyakova / Transport of Russia: weekly information & analytical newspaper [E-source]. – URL: http://transportrussia.ru/item/2362-effektivnost-gchp.html (Accessed: 11.03.2017)

Federal law of the RF dated July 13, 2005 No. 224-FZ “On public-private partnership and municipal-private partnership in the Russian Federation and amendments into certain legal acts of the Russian Federation” // Russian Newspaper [E-source]. – URL: http://www.rg.ru/2015/07/17/g4p-dok.html (Accessed: 01.02.2017)

Federal law of the RF dated July 21, 2005, No. 115-FZ “On concession agreements” // Russian Newspaper [E-source]. – URL: https://rg.ru/2005/07/26/koncessii-dok.html (Accessed: 11.11.2016)

Federal portal “Public-private partnership” [E-source] // Access: URL: http://www.pppi.ru/projects (Accessed: 24.02.2017).

1. Voronezh State Technical University, Voronezh, Russia. Email: e-mail: upr_stroy_kaf@vgasu.vrn.ru